Should I Get a Cash Back Mortgage?

Should I get a cash back mortgage? In past years I’ve almost advised mortgage clients against it. Today’s cash back mortgages have made changes and really improved their game. Maybe it’s time to reconsider.

There’s no such thing as a free lunch.

John Ruskin

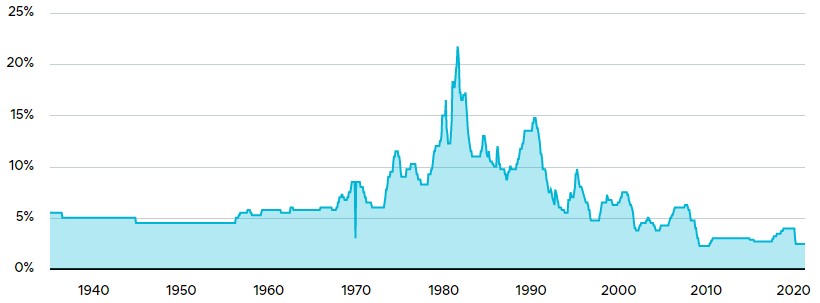

A wise uncle once told me (not his original quote), there is no such thing as a free lunch. I’ve taken that advice to heart and in most ways it’s worked out well as a guiding money management principle. Cash back mortgages at first glance seem like just the type of mortgage product this age old advice was warning us about. However, in recent years cash back mortgages have become much more competitive and the rates charged for them are now much closer to prime discounted rates. For this reason cash back mortgages are becoming more and more popular. Let’s take a look and see if the math actually adds up in their favor or not.

Cash Back Mortgages in a Nutshell

- You get no strings attached upfront money to spend on whatever you choose with the exception that it cannot be used towards a down payment.

- In return you are charged a higher rate of interest for the term of the mortgage

- You can receive a cash back equal to 1% to 3% of the total amount borrowed for high ration insured mortgages (less than 20% down) and up to 5% of the total amount borrowed for conventional mortgages (more than 20% down).

- If you pay the mortgage off before the end date of the mortgage term you signed up for (usually 5 years) you have to pay back a pro-rated portion of the cashback.

Pay it back? I thought it was free money!

It is free in the sense that you don’t have to pay it back as long as you don’t fully re-pay the mortgage earlier than the end of the term. Below is an sample scenario to demonstrate how it might apply.

You sign up for a 5 year fixed term and receive $5000 as a cash back rebate on the closing date. After 4 years you decide sell the home and payout the mortgage. Since you have 1 year remaining on your 5 year mortgage term you will be asked to pay back a portion or 1/5th of the original cash back received. This is added on to whatever standard mortgage penalty might also for breaking the mortgage early. One way to avoid all of these charges would be to port the mortgage over to a new property but that’s a discussion for a different day. The other way is to make sure you actually plan to live in your house for a minimum of 5 years before you sign up for this type of mortgage.

So now you understand the concept of how cash back mortgages work. Does this now prove that that cash back mortgages are simply a clever banker’s invention designed to boost the bank’s bottom line and part us from our money? Or is there a time and place where cash back mortgages actually make good financial sense? Let’s see where the math leads us.

Cash Back Mortgage vs Full Discounted Mortgage

Let’s contrast 3 different scenarios where you can use a cash back mortgage instead of a standard discounted mortgage. For comparison purposes let’s assume the following:

$400,000 CMHC high ratio mortgage 3% Cash Back Mortgage Rate: 2.79% Basic Fixed Mortgage Rate: 2.04% Amortization: 25 Years Term: 5 Years

Scenario 1: Cash Back spent on whatever your heart desires.

| Mortgage Type | Cash Back | Basic | Cost/ Savings |

| Cash Back | $12000 | N/A | +$12000 |

| Monthly Payment | $1850 | $1702 | – $8916 |

| 5 Year Balance | $340507 | $335362 | – $5144 |

| Net Savings/ Cost | WINNER | – $2061 |

Standard Discounted Mortgage Wins! A cashback will COST YOU $2061.39 or 45.36/month over the 5 Year Term which is the equivalent of borrowing $12,000 at approximately 3.4%.

Scenario 2: Mortgage Cash Back pays down your 19% APR Credit Card

| Mortgage Type | Cash Back | Basic | Cost/ Savings |

| Cash Back | $12000 | N/A | + $12000 |

| Monthly Payment | $1850 | $1701 | – $8916 |

| 5 Year Balance | $340507 | $335362 | – $5144 |

| 5 Year Cost on $12000 Credit Card | N/A | $311.29* X 60 months =$18677.40 | +$18677 |

| Total Cost or Savings | WINNER | 16,616 |

3% Cash Back Mortgage Wins! A cash back mortgage will SAVE YOU $16,616.31 or $276.94/month over the 5 year term.

Scenario 3: Mortgage Cash Back pays off your 6% APR Personal Loan or Auto Loan

| Mortgage Type | Cash Back | Basic | Cost/ Savings |

| Cash Back | $12,000 | N/A | + $12000 |

| Monthly Payment | $1850 | $1701 | – $8916 |

| 5 Year Balance | $340507 | $335362 | – $5144 |

| 5 Year Cost on $12000 Loan | N/A | $231.99* X 60 months =$13919.40 | + $13919 |

| Total Cost or Savings | WINNER | 11,858 |

3% Cash Back Mortgage Wins! A cash back mortgage will SAVE YOU $11,858.01 or $197.63/month over the 5 year term.

The Verdict

As long as the difference between the best discounted fixed rates and the cash back mortgage rates remain as close as they have been recently, the answer is a resounding “it depends”. Sorry, mortgages are rarely all or nothing.

If you are paying out debts with your cash back mortgage it makes sound financial sense in most cases. The more expensive the debt, the more compelling the argument in favour of cash back mortgages. Our general guideline is that if the debts you are paying out will take longer than a year doing it on your own, savings are likely to had paying it out immediately with a cash back.

On the other hand, if you are planning to treat the cash back as bonus money destined for more recreational or discretionary spending then the math isn’t really in your favour. Assuming your main motive is saving money, this is likely not the time for a cash back mortgage. But if your motive is simply secure some relatively cheap cash for a trip, wedding, renovation, seeding a savings account or if you were intending to borrow the money anyways, a cash back is still a great option.

Reach out to our team if you have any other questions about cash back mortgages and their suitability for you.