How to purchase a rental property

If you are wondering how to purchase a rental property you will most likely need a mortgage to finance it. The process for getting approved for a rental property mortgage is quite a bit different than purchasing a residence so here are a few key things to keep in mind from the very beginning.

What is the minimum down payment required?

Rental Properties that will be solely occupied by renters

20% down is the minimum required if you are purchasing a property that will be occupied only by your renter or renter(s).

Rental Properties that you will both live in yourself AND rent

As little as 5% down may be required if you are buying a property that has multiple legal units or a legal suite and you plan to live in one and rent out the other.

A few examples of these types of properties are:

- house with a legal basement suite

- side by side or up down duplex

- 3 unit triplex

- 4 unit fourplex (minimum down payment is 10% on these)

Can I use rental income to help me qualify?

Yes. You can use the rental income that you will collect from owning the rental property to help qualify you for the mortgage. Different banks and lenders use different calculations to determine how much of that income they can use in your qualification but most will accept at least 50% of the potential rent added to your income. Several lenders allow a more beneficial calculation that can go up to 80% when required. For most properties that means you will still be using all of your personal employment income to help qualify for the mortgage on your future rental property.

What additional costs should I expect when buying a rental property?

Purchasing and owning a rental property can include a few additional costs that aren’t always always identical to purchasing and owning an owner-occupied home or primary residence.

- Property Appraisal

- Market Rents Appraisal

- Property Management

- Accounting

- Taxes

What are the benefits to owning rental property?

In additional to discussing how to buy a rental property, we should probably talk about why you should buy one. All types of investing involves a level of risk. However, a well managed property, in a good location, purchased for a good price can be one of the safest investments. Real estate investing should not be taken on as a get rich quick scheme but rather a get rich slow strategy. Here are a few of the the key benefits to owning real estate.

Leverage

Real estate is an investment class where you can easily use leverage. Leverage is a technique that allows you to control a large asset with a relatively small investment. For example, let’s say you purchase a $500K rental property with a down payment of $100K (20%) and a mortgage of $400K. You now effectively control an asset valued at $500K but only used $100K of your money to do so. This is called financial leverage and it is one of the reasons real estate is a popular investment class.

Capital Appreciation

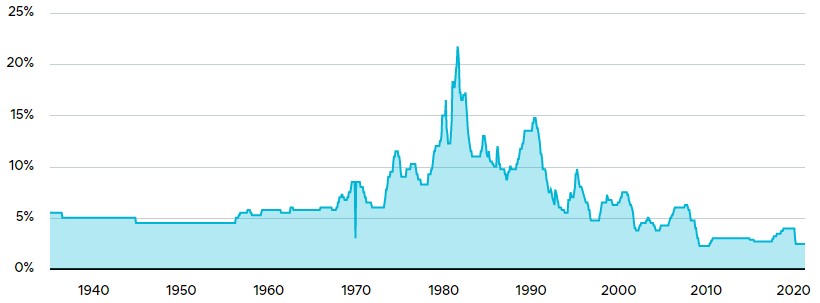

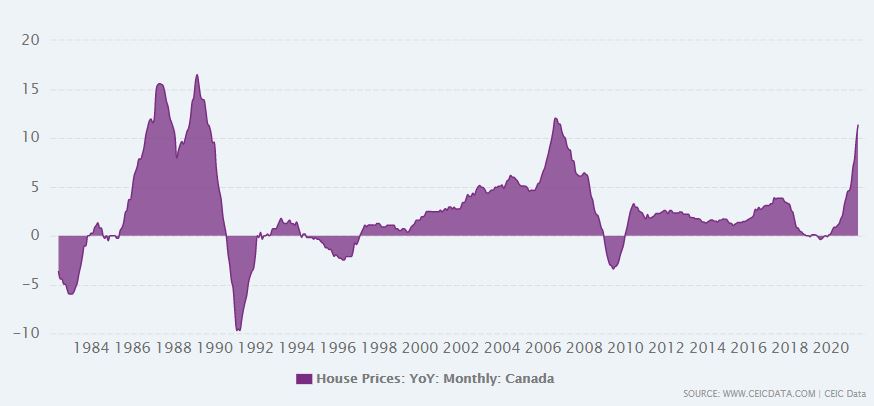

Real estate over time has increased in value. Below is a chart that shows the yearly percentage increases or decreases that have occurred in Canadian Real Estate from 1982 to 2021. As you can see real estate can go both up and down but on average it has increased in value more often than not.

When you combine capital appreciation and leverage, your return on investment rate can go up exponentially. Take the same simple example of a $500K purchase we used above in our discussion of leverage.

Let’s assume that in a given year your real estate investment appreciates 5%. A 5% appreciation on $500K is $25K.

| New Property Value | $525K |

| Original Mortgage Balance | $400K |

| New Increased Equity | $125K |

| Original Investment/Down Payment | $100K |

| Profit is 25% ROI | $25K |

Of course a 25% return should not be expected every year but the example shows how appreciation and leverage work together in real estate.

Cash Flow

Cash flow represents an additional benefit of investing in real estate. Normally when you invest in a rental property you will earn rent income from the tenants who occupy your property. When you buy the right property, the rental income will cover all your carrying costs such as mortgage payments, property taxes, maintenance and repairs, and hopefully put a little extra into your pocket at the end of every month (this is your profit).

Buying a property that has strong cashflow can help reduce the risks of investing in real estate since even if the property doesn’t go up in value as much as you expected over time, you have a tenant slowly paying off your mortgage and covering the costs of owning the property. After 25 years you’ll still end up owning a free and clear income producing asset.

Beware of purchasing a rental property that has negative cash flow. This will take money out of your pocket every month and defeats the purpose of investing. Buyer beware – always do your own research and make sure you are confident that the projected rental income will at the very least cover the costs of owning the property and preferably put money into your pocket each month as well.

If you’d like to learn more about how to purchase a rental property or how to get a mortgage on a rental property please contact our team or apply online. We look forward to working with you.