Fall 2021 Mortgage Review

What is happening with mortgage rates?

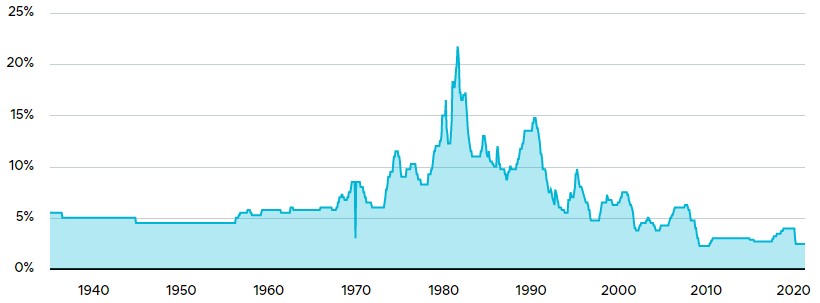

As most people in Canada are now aware, mortgage rates have been historically low and getting lower pretty much since March of 2020. As is human nature, it doesn’t take long for all of us to begin believing these rates are the new normal. But are they? It appears the trend may be beginning to reverse. That means it’s a good time for a fall 2021 mortgage rate review.

In the past month, Canada 5 Year Government Bond yields went from a low of .78 up to high of 1.09 as of Sept. 28th. Most of that happened in the last week. That’s a pretty significant move. These yields are what mortgage lenders in Canada base their fixed rate residential mortgage rates off of. In response to these increases, many of our lenders have already bumped up their 5-year fixed rates accordingly. For example, last week we had many lenders offering 1.89% for a standard high ratio full featured 5 year fixed rate mortgage. Today many of those same lenders are now in the 2.19-2.24% range.

The Bank of Canada target rate of .25% has remained unchanged since March 2020, so variable rate mortgages, which are directly affected by the Bank of Canada, are still currently the cheapest mortgage products available and can start as low as 1.25% for strong high ratio applicants.

What should we expect going into 2022?

I won’t pretend to be an expert at predicting future mortgage rates. Let’s face it, even the experts rarely get it all right. It does, however, feel like a safe bet that there will be more rate increases than drops going forward. Most of the major financial institution’s gurus are predicting that the Bank of Canada will hold steady until late 2022. Even then increases are expected to only be in the .25% range for the whole year. In 2023 many are predicting more aggressive increase between .50% to .75%. All of this is subject to unforeseen major events in both the Canadian and World economies.

How do I do my own fall 2021 mortgage review?

It’s important to have some perspective here. Even with the increases that have happened recently, rates overall are still incredibly low. Far lower than they were prior to the beginning of 2020. It would take several years worth of increases before we even get back to that baseline which for that time was still considered historically low. What that all means is this is not a time to panic. This is simply a time to consider some minor tweaks depending on your current situation.

If you are currently in a fixed rate mortgage my recommendation is to simply stay the course in most cases. Once you are within four months of your renewal date please contact us and we’ll lock in the best possible rate at that time so that if rates increase further you are protected. If rates drop lower then we can still get the new lower rates. Win Win.

If you are currently in a variable rate mortgage you have three main options.

1) Contact your lender and request a lock in rate quote. It will certainly be higher than what you are paying now but then you can decide whether the higher costs are worth paying to avoid the risk of higher future rates.

2) Use your payment increase privileges to start increasing your regular mortgage payment to match what the rate would increase to if you did decide to lock in. This allows you to continue to enjoy a very low rate in the near term while paying off your mortgage faster giving you a lower overall mortgage balance when rates do begin to rise. This technique protects you against a future payment shock if you have to renew into a higher interest rate market place.

3) If there is a chance you may be selling the property or refinancing your mortgage in the next few years you probably want to just stay in a variable rate as it always has the lowest possible breaking penalties. Switching to a fixed rate mortgage and then selling shortly thereafter can be a costly decision as the fixed rate penalties can be high, especially with Canada’s major banks.

If you are currently deciding on a new mortgage and are wondering whether fixed or variable is right for you check out this article.

Hopefully this fall 2021 mortgage rate review will give you a few ideas about how to manage your mortgage choices. If you are still unsure where you stand feel free to reach out to our team and we can give you a more personalized analysis.

~Mark Kostelyk