Fixed Rate vs Variable Rate

Trying to decide if you should get a fixed rate mortgage or a variable rate mortgage? Well you aren’t alone. Each mortgage type has pros and cons that should be considered. Let’s start by looking closely at each type of mortgage and comparing them to see which will be a better fit for you.

What is a fixed rate mortgage?

When you choose a fixed rate mortgage you are securing an interest rate for a selected term of years. The most common fixed rate mortgage term in Canada is 5 years. Terms as low as 1 year and as long as 10 years are also available. Selecting a fixed rate mortgage guarantees you a specific rate and payment until the term of the mortgage expires.

What is a variable rate mortgage?

A variable rate mortgage (VRM) is a mortgage where the interest rate is subject to change during the term of your mortgage. Most VRMs are set up on a 5 year term. The rate you receive is based on a discount or premium in relation to the Prime Mortgage Rate. Assuming a Prime Mortgage Rate of 3%, a VRM at Prime minus 0.75% would equal an actual rate of 2.25%

The The Bank of Canada meets eight times per year to decide whether to increase, decrease or leave unchanged, Canada’s Prime Lending Rate (BOC Rate). This decision in turn affects the Prime Mortgage Rate your lender is able to offer you. That means your mortgage payment could move up, down or remain unchanged each after each meeting. Recently, rate changes have been fairly rare and do not usually exceed moves greater than 0.25% or 0.50%.

Advantages of choosing a fixed rate mortgage

The main benefit of a fixed rate mortgage is in the name. Your rate and payment are fixed for the term of the mortgage. This provides you with peace of mind and security against sudden interest rate spikes. You also gain the benefit of a consistent mortgage payment which makes managing your cashflow easier. For most Canadians these reasons alone make it an easy choice.

Advantages of choosing a variable rate mortgage

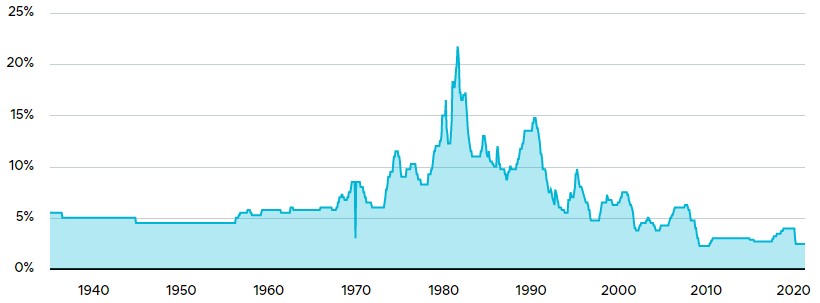

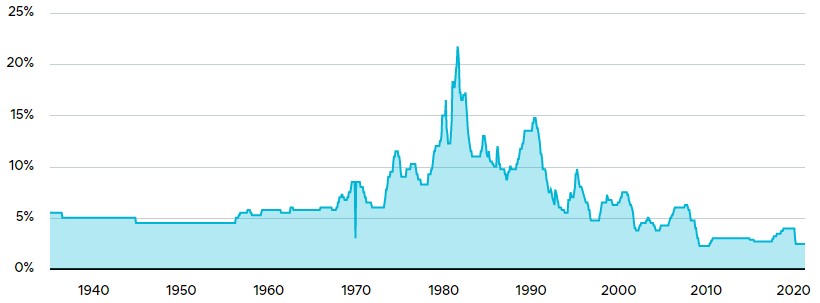

The biggest advantage of going with a variable rate mortgage is a lower current interest rate. The down side of choosing variable is you are exposing yourself to the risk of future rate increases. Over time variable rates have outperformed fixed rates but as you can see from the graph below, there have been periods of time where variable rate mortgages have increased dramatically in a short time. An extreme example of this was September 1981 when Bank Prime rose to a eye watering 21.25%. Have rates this high been common over most of the last 80 years? No. Is it possible that it could happen again? Yes. Is it likely to ever go that high again? Most experts say no but it is possible.

Variable Rate Risk Reduction Strategy

If you are inclined to lean towards a variable rate mortgage preference there are some strategies you can use to reduce your overall risk.

A simple way is to set your regular payment at the higher amount it would have been if you had selected a fixed rate mortgage. By doing this you actually paydown your principal faster while also enjoying the benefit of the lower variable interest rate. At the end of your term, even if the variable rate has moved higher, you are still likely to be ahead because of your extra principal payments early in the term. Another way to achieve a similar benefit is selecting a 25-year amortization and setting your payment based on a 20-year amortization.

Locking-in Variable Rate Mortgages

Almost all VRMs have the ability to be converted into a fixed rate. When selecting a variable rate mortgage it is important to ask if your lender will offer their best discounted fixed rates, posted rates or a “negotiated” rate if you choose to lock-in to a fixed rate. Unfortunately borrowers have limited leverage in this type of negotiation. Canada’s large retail banks will normally offer posted rates or a “negotiated” rates at conversion. Mortgage companies, also known as monolines, normally offer their best discounted rates at conversion. Assuming the variable rate being offered is comparable, it makes more sense to use a lender who will guarantee you their discounted fixed rate at conversion.

Variable vs Fixed Rate Mortgage Penalties

This is an often overlooked consideration when choosing between a fixed rate mortgage or a variable rate mortgage. Regardless of which you have chosen, if you need to sell your property or decide to payout the mortgage early for any reason, you will be charged a mortgage breaking fee or “penalty”.

For fixed rate mortgages this is typically the greater of 3 month interest or an interest rate differential (IRD). The IRD is a calculation that is used to determine how much interest revenue the lender will lose by allowing you to repay your mortgage early. Different lenders have different ways of calculating this but in general IRD penalties can be very expensive. It is not uncommon for them to be thousands of dollars more than a simple 3 months interest charge.

If you have a variable rate mortgage your early payout penalty is limited to a 3 months interest penalty which is both easier to calculate and much smaller than an IRD penalty. For this reason alone, if there is a likely chance that you will be paying your mortgage off early or selling your home before the mortgage maturity date, getting a variable rate mortgage is probably a better financial decision.

What is the right choice for me?

Variable rate and fixed rate mortgages both have their advantages and disadvantages. As mentioned previously, with history as a guide, homeowners have typically had lower payments and interest rates with variable mortgages. But there have been times when variable rate mortgages have increased quickly and during those times borrowers would have been better to have had a locked in fixed rate.

The real question is what is the level of uncertainty you wish to tolerate. If the idea of potential rate increases keeps you up at night (remember the Bank of Canada meets 8 times per year) perhaps a variable rate mortgage is not the best fit for you. On the other hand, if you want to enjoy the lowest possible rate and can accept the risk of unexpected rate increases for periods of time, going with a variable might just the right option for you.

Feel free to contact our team to learn more about the differences between fixed and variable rate mortgages.