Fixed Rate vs Variable Rate Mortgages

Unless you’ve been avoiding the news for the past couple months or out of internet service you’re probably aware mortgage interest rates have been rising rather quickly. If you are in a fixed rate mortgage this won’t affect you right away depending on when your mortgage renews. The benefit of a fixed rate mortgage is that it stays the same for the full length of the mortgage term you selected at the beginning. On the other hand, if you’ve chosen a variable rate you are likely seeing increases to your rate and payment recently. This is the nature of a variable rate mortgage. The basic tradeoff is that you receive the benefit of a lower interest rate in return for the risk that it can/will rise and fall from time to time.

Should I lock in my variable rate mortgage?

The challenge is how do we respond to rising rates. The issue at hand is there is no guaranteed right decision as we don’t have access to all the information via a proverbial crystal ball. We don’t know when rates will stop climbing. We don’t know when they will begin to drop again.

Do we “lock it in” and jump immediately to a higher rate in return for knowing it can’t go any higher than that for an extended period OR do we keep riding the variable train (which is usually 1.25 -1.5% lower than fixed) expecting that eventually rates will stabilize and fall back down, as has happened in the past?

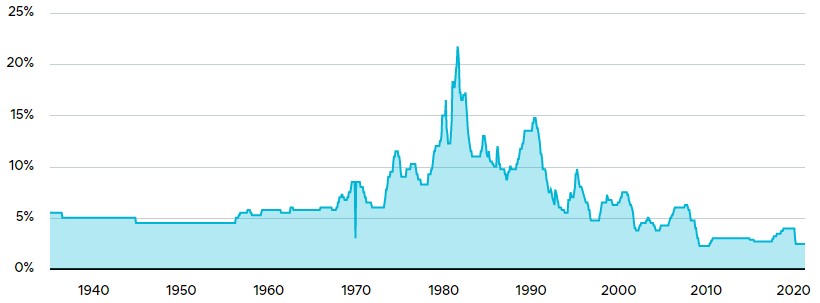

When do rates usually drop? Normally rates should stop climbing and start dropping when inflation is tamed, when we enter a recession/slowdown or a combination of both.

The risk of locking in now is that you may be locking in at a time when things begin to turn. This means you could be paying 5% or more for the next 5 years even though rates in a year or two could be trending back down below that.

Should I stick with my variable rate and ride it out?

On the other hand, the risk of not locking in right now is that current fixed rates could continue to rise even higher and then you might choose to lock in later at an even higher rate. Historically, borrowers who stay variable do save money in the long run so for almost all variable rate mortgage customers, it is not usually a good option to lock in.

The best choice for you will be personal. If the rate increase headlines and notices are taking a toll on you mentally and you need to know what your payment will be (even if it is higher than what you pay currently) for the next 5 years then locking in a fixed could be the right choice. Consider it like paying a premium for some peace of mind insurance.

If you feel you can afford additional rate hikes in the nearer term and it won’t put you at financial risk then staying variable is probably the right choice for you as you’ll be the first to benefit when rates stabilize or start to drop.

Increasing Mortgage Rate Hedge Strategy

There is more to a mortgage than interest rate. Sometimes having the right strategy can save you far more than simply shopping for the lowest possible rate. An example of this is a strategy we refer to as the Increasing Mortgage Rate Hedge Strategy. Basically it works like this. Rather than renewing or locking into a fixed rate mortgage, you stay with the lower variable mortgage rate but set your regular payment as if you had locked in. This mortgage strategy gives you the best of both worlds since the higher payment (set based on current fixed rates) will be directing more of the payment to principal as you enjoy the lower variable rate mortgage interest savings. Even if the variable rate increases further you’ll still have paid more down on your principal than you would have otherwise and next time your mortgage matures, you will be renewing at lower principal balance than before.

Selling your home soon?

One important caveat. Be careful if selling your home in the near term is part of your plan. Fixed rates have higher breaking penalties than variable in almost all cases so if you are selling soon, you should probably stay variable as the breaking penalty is usually only the minimum charge (three months interest penalty).